FISME Secretary General Anil Bhardwaj said that at least 50% of MSMEs have slipped to SMA 1 & SMA 2 categories and may turn into NPAs if lockdowns persist under the second wave of Covid-19.

On May 5, Reserve Bank of India (RBI) Governor Shaktikanta Das announced additional relief measures in light of the second wave. The announcements included loan restructuring facilities for individuals, small businesses and Micro, Small & Medium Enterprises (MSMEs).

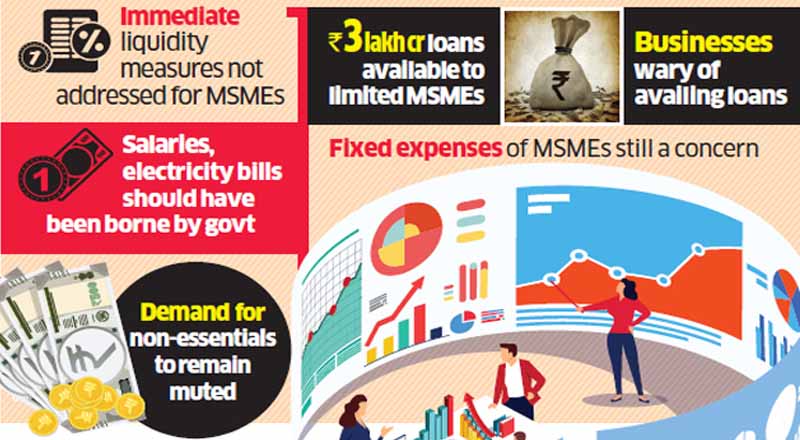

But, industry voices believe that a lot more needs to be done to save these businesses which are on the verge of collapse as an aftermath of a complete lockdown in 2020 when the pandemic began, and now a much harsher second wave along with fragmented lockdowns.

In an interview to ET Now, Anil Bhardwaj, the Secretary-General of Federation of Indian Micro Small and Medium Enterprises (FISME) said that the conditions to avail loan restructuring are barriers for a large chunk of the sector. “All segments except pharma and to some extent food packaging are suffering. Mumbai and NCR are supply chain hubs, if they are under lockdown, the entire ecosystem gets affected. Business owners, employees and their families have also fallen prey to the virus,” Bhardwaj said

At least 50 per cent of MSMEs have slipped into SMA 1 and 2 categories, according to Bhardwaj. If the current situation persists and further relief is not extended, these accounts risk slipping further to SMA 3 and Non-Performing Assets (NPA), he added.

Das had announced that individuals, small businesses and MSMEs having an exposure of up to Rs 25 crore and have not availed restructuring under any of the earlier restructuring frameworks shall be eligible to be considered under Resolution Framework 2.0. These accounts must be standard as of March 31, 2021.

Individuals and small businesses who already availed restructuring under Resolution Framework 1.0, where the resolution plan permitted a moratorium of fewer than two years, lending institutions were permitted by the RBI to modify such plans including increasing the period of the moratorium and/or extending the residual tenor up to a total of two years. Lending institutions have also been permitted a one-time review of working capital sanctioned limits for small businesses and MSMEs.

Bhardwaj said, “The upper limit of Rs 25 crore eliminates the entire medium enterprises sector and also the comparatively bigger businesses under the small enterprises’ category. Businesses that employ a large number of people are excluded with this limit.”

“Additionally companies which were standard and doing well as on March 31, 2021, will benefit despite the fact that the entire last fiscal has been a pandemic year. All those who suffered last year will continue to suffer,” he explained.