Finance minister Nirmala Sitharaman speaks during her maiden budget speech on February 1 on the stake sale in the insurer in the next fiscal and the government has decided to get LIC listed on the markets it is the target for FY21 . It proposes to sell a part of the government’s holding in Life Insurance Corporation (LIC) by way of Initial Public Offer (IPO). LIC will be India’s most valuable firm if listed.

The Life Insurance Corporation of India was founded in 1956 when the Parliament of India passed the Life Insurance of India Act that nationalised the insurance industry in India. Over 245 insurance companies and provident societies were merged to create the state-owned Life Insurance Corporation of India, with an initial capital of Rs 5 crore and an asset base of Rs 352.20 crore, LIC today has assets of over Rs 28.45 trillion with life fund to the tune of Rs 25.84 trillion.

Over the years, LIC has been the lifeline for the Government’s disinvestment program and the government sources says, the listing of LIC will improve Government finances, enhance corporate governance. Now, Modi government has set an ambitious divestment target of Rs 2.1 lakh crore for FY21 and expects to garner nearly Rs 70,000 crore through partial stake sale in LIC.

This was the most positive announcement amongst the measures announced for the financial sector and the question is on how it can help unlock value and most importantly how much it can add to the government’s kitty.

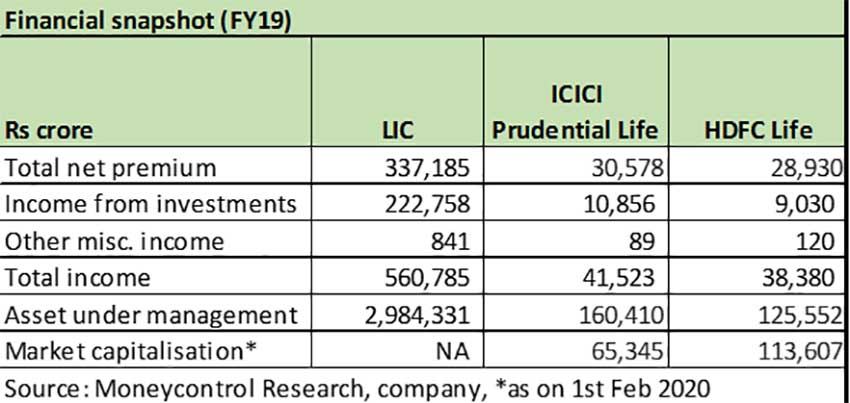

Market capitalisation wise LIC is likely to become the country’s biggest company with an estimated valuation of Rs 8-10 lakh crore ,it would be the IPO of the decade, next to the Saudi Aramco listing. Even a 10 per cent dilution will be difficult for market to absorb in one go and the government may look at doing this in lots.

When we look at the political history, LIC has been the lifeline for the Government’s disinvestment programme for many years now. Successive governments — earlier the Congress-led United Progressive Alliance (UPA) and now the BJP-led National Democratic Alliance (NDA) in an unprecedented manner — have used LIC to meets its divestment agenda.

LIC is entrusted with the hard earned savings of the people of India and the money that LIC manages is not the government’s money. All of LIC’s money comes from the premium paid by policyholders on which it has to offer competitive returns. The insurance and pension funds of millions of policyholders demands far greater transparency and accountability.

Listing LIC could also help reduce costs of the exchequer. If LIC is listed, it would be the most valued company in the country with the highest valuation as well as one of the largest across the world. LIC enjoys market leadership even as India opened up the insurance sector to private players 19 years ago.

LIC chairman M R Kumar said LIC will be listed on the stock exchanges in the second half of FY21; on IDBI Bank says that may not wait for completion of 12-year period given by RBI to reduce stake to 15%.

LIC continues to have a giant market share. LIC has continued to lead the market with a 66.24 percent of the market share in total first year premium and 75 percent in new policies in FY19.

LIC is one of the cash-richest companies in India and it’s gross NPAs rose to 6.10 per cent in the first six months (April-September) of 2019-20. Gross NPAs have almost double in the last five years. The insurer always maintained a stable 1.5-2 per cent gross NPAs.

On employee protest against proposed IPO: The LIC IPO does not mean privatisation as some people are suggesting. The government is only divesting a part of its stake. Most of the private sector banks are listed and so are PSU general insurers. But these entities continue to be government-owned. There will no problems for LIC employees, they will continue to be staff. We will be talking to them (protesting staff) and clarify this.

On brand perception ahead of IPO: The perception is very positive for us as of now. We have 29 crore policyholders and 12 lakh agents. I cannot think of any other organisation that has gone for an IPO with such a base. If there is any negative perception among some employees and any investor we will address it. With a listing, both transparency and corporate governance will improve.

BJP MP and former union finance minister Jayant Sinha said, disinvestment of the LIC as proposed in the Union budget would be beneficial for both the central government and the LIC. The capital raised post-divestment could be used in building infrastructure while the move would also bring in “accountability, transparency and efficiency” in the insurance behemoth, he told a press conference.

With more than 10 lakh crore capital of the LIC would be helpful for us all. It could help us get funds for constructing infrastructure like medical colleges,” Sinha said.

Lastly, given the dire state of the economy and sluggish tax revenues, government finances need a big shot in the arm and listing LIC could be just what the doctor ordered.