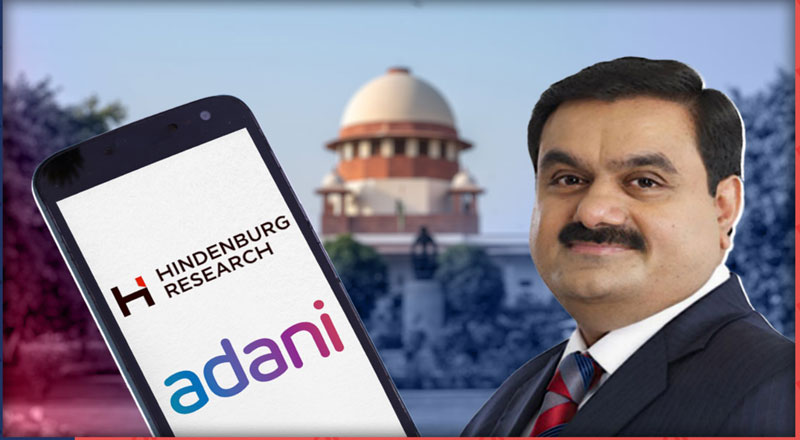

- The Supreme Court ordered the setting up of a committee to probe the recent Adani Group shares crash triggered by Hindenburg Research’s fraud allegations.

- A bench directed the Securities and Exchange Board of India (Sebi) to investigate the allegations in the Hindenburg Research Report against the Adani Group.

- Sebi shall file a status report on its investigation before the Court within two months. It shall also investigate whether there has been a violation of Sebi rules or whether there was any manipulation of stock prices.

- A bench headed by CJI said, “We will select the experts and maintain full transparency. it will not accept the sealed cover suggestion by the Centre to form an expert committee.

- “The Supreme Court has kept the interests of investors as paramount. SEBI, which is the protector of investors’ interests, has been directed to expedite the investigation”. A senior advocate said.

A bench of Chief Justice D Y Chandrachud and Justices P S Narasimha and J B Pardiwala delivered its verdict over setting up of a panel of domain experts for strengthening existing regulatory measures for stock markets.

The Supreme Court on Thursday ordered the setting up of a committee headed by ex-SC judge AM Sapre, including KV Kamath and Nandan Nilekani to probe the recent Adani Group shares crash triggered by Hindenburg Research’s fraud allegations. This committee will review regulatory mechanisms and protect investor interests in light of the report by American short-seller Hindenburg Research against the Adani Group of companies.

A bench directed the Securities and Exchange Board of India (Sebi) to investigate the allegations in the Hindenburg Research Report against the Adani Group. The regulatory body must also probe whether there has been a failure to disclose related party transactions. Sebi shall file a status report on its investigation before the Court within two months. “Sebi shall also investigate whether there has been a violation of Section 19 of Sebi rules (Sebi power to issue directions), or whether there was any manipulation of stock prices,” the CJI said.

The bench noted that Sebi is already investigating the allegations made by American short-seller Hindenburg Research against the Adani Group. “Sebi said it was enquiring into market activities immediately “preceding and post the publication of the report”, to detect if there were violations of its regulations,” said the CJI.

The Supreme Court on February 17 (last hearing) said it will not accept the sealed cover suggestion by the Centre to form an expert committee to examine the report by Hindenburg Research against the Adani Group and its impact on the markets. A bench headed by CJI DY Chandrachud said, “We will select the experts and maintain full transparency. If we take names from the government, it would amount to a government-constituted committee. There has to be full (public) confidence in the committee.”

Commenting on the verdict, Tushar Agarwal, advocate, Supreme Court of India said, “It is expected that this committee will uphold the trust of Indian Investors by suggesting few measures to strengthen the Security Market and reduce the volatility factor in the market to discourage speculation which ultimately affects the entire market as well as economy.”

“The Supreme Court has kept the interests of investors as paramount. SEBI, which is the protector of investors’ interests, has been directed to expedite the investigation. This, coupled with the fact that SEBI is already investigating the Adani group, shows the Supreme Court has faith in SEBI,” said a senior advocate, Delhi HC.