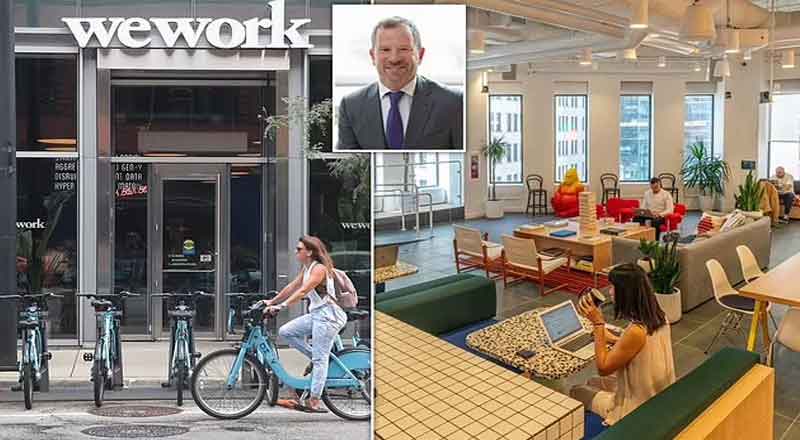

- WeWork Inc, a co-working company, was once a high-flying start-up valued at $47 billion that has struggling in the aftermath of the pandemic.

- WeWork, the New York-based company listed both assets and liabilities in the range of $10 billion to $50 billion in a Chapter 11 petition.

- WeWork’s real estate footprint sprawled across 777 locations in 39 countries as of June 30, with occupancy near 2019 levels. But the enterprise remains unprofitable.

- WeWork’s bankruptcy filing allows it to keep operating as it chalks out a debt repayment plan.

- WeWork India said it operates independently and WeWork Global’s bankruptcy filing in the US will not impact its stakeholders in India.

- WeWork India has been profitable since 2021, a statement said.

- WeWork India said it is backed by majority stakeholder Embassy Group and is committed to investing in the future of its business.

Former high-flying start-up WeWork Inc. filed for bankruptcy, marking a fresh low for the co-working company that struggled to recover from the pandemic and its failed initial public offering in 2019. The New York-based company listed both assets and liabilities in the range of $10 billion to $50 billion in a Chapter 11 petition filed in New Jersey. The filing allows WeWork to keep operating while it works out a plan to repay its debts.

The company reached a sweeping debt restructuring deal in early 2023 but quickly fell into trouble again. It said in August that there was “substantial doubt” about its ability to continue operating. Weeks later, it said it would renegotiate nearly all its leases and withdraw from “underperforming” locations. WeWork’s real estate footprint sprawled across 777 locations in 39 countries as of June 30, with occupancy near 2019 levels. But the enterprise remains unprofitable.

WeWork India on Tuesday said it operates independently and WeWork Global’s bankruptcy filing in the US will not impact its stakeholders in India.

“WeWork India is a separate entity and will continue to operate and serve our members, landlords, and partners as usual. Committed to the growth and success of our business,” it said in a post on X, formerly Twitter.

WeWork India said its global unit has initiated an important strategic reorganization process in the US, along with recognition proceedings in Canada in a step towards improving its business’ economics. The bankruptcy filing allows it to keep operating as it chalks out a debt repayment plan.

As of June 30, the company maintains a real estate presence across 777 locations in 39 countries but remains unprofitable. However, WeWork India has been profitable since 2021, the statement said.

“The process restructures the debts and the leases of WeWork Global in the US and Canada. During this period, we will continue to hold the rights to use the brand name as part of the operating agreement, while serving our members, landlords, and partners as usual,” it said.

WeWork India said it is backed by majority stakeholder Embassy Group and is committed to investing in the future of its business.

WeWork Inc. went public in 2021, two years after its initial public offering (IPO) failed amid investor concerns over valuation and growth prospects. Founder Adam Neumann had to resign as CEO following a fall in WeWork’s valuation.

(With inputs from agencies)