Current News

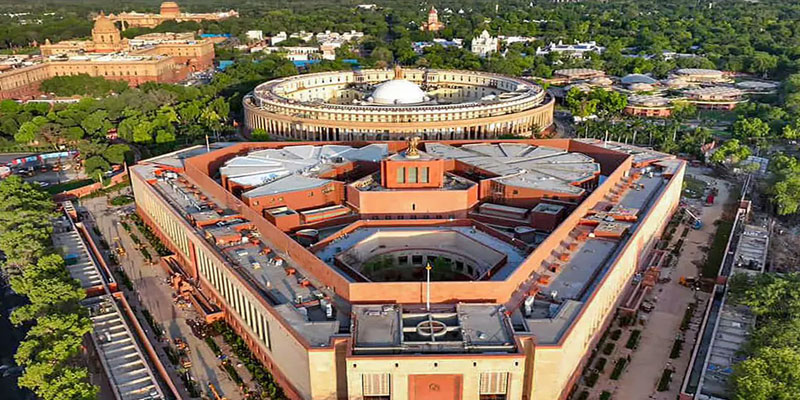

Politics

Rethinking Power: Why India Needs a Smar...

India at a Crossroads: Big Challenges, Bigger Responsibilities India in 2025 stands at a pivotal moment in its democratic journey. With a population exc...

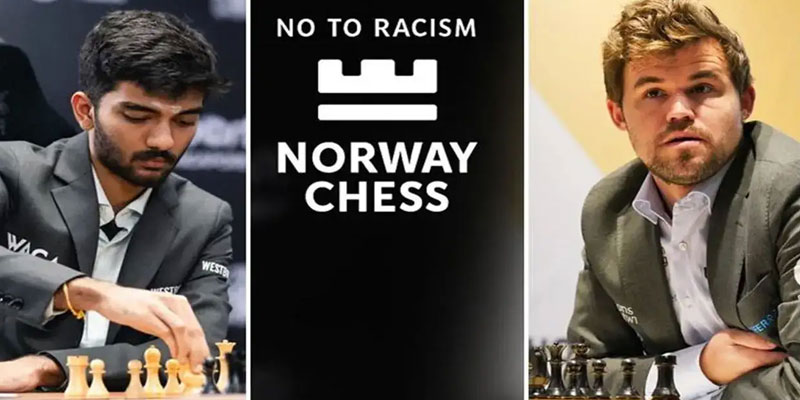

Sports

Tilak Varma to Play County Cricket for H...

Young Indian batting sensation Tilak Varma is all set to make his debut in English domestic cricket as he joins Hampshire for the County Championship. The 22-ye...

View More News

Copyright © All rights reserved. The images belongs to the respective copyright holders.