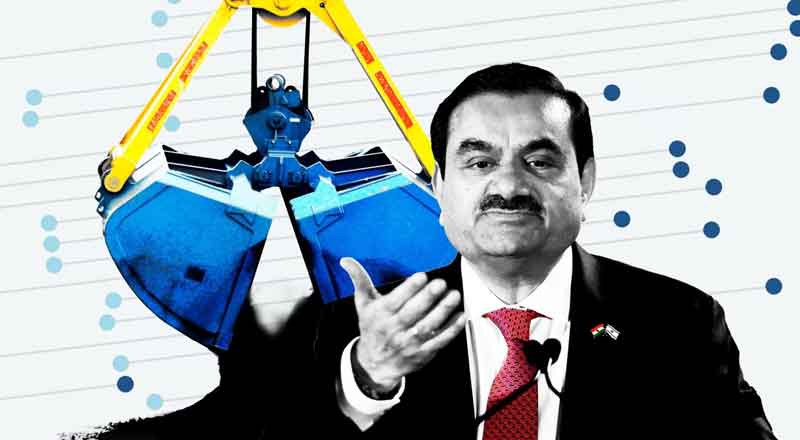

The Adani group has been rocked by another damning report that claims it imported billions of dollars of coal at prices well above market prices, igniting suspicion that the country’s largest private importer of coal has been inflating fuel costs and forcing consumers and businesses to overpay for electricity.

The London-based Financial Times pored over customs records since July 2021 and found that the Adani group paid a “total of $4.8 billion to the three companies for coal sourced at substantial premiums to market prices”.

The three offshore intermediaries based in Taiwan, Dubai, and Singapore received a “black premium” that was “at times more than double the market price”, the report said.

The Adanis maintained a studied silence after the latest report fired another broadside against the group’s flagship Adani Enterprises, which has been rattled by several exposés since the US short-seller Hindenburg Research report in January that sparked a massive meltdown in the Adani group’s market valuation in February.

The Adani group had been so rattled by reports that the newspaper’s journalists had started an exhaustive investigation into coal imports by the group, often rapping on doors, making calls, emailing questionnaires and even shoving written questions under the door of one office in Singapore — that they took the unprecedented step of making a regulatory filing with the bourses to rubbish an upcoming report by the Financial Times.

It had accused the FT of continuing with its relentless campaign to tarnish the image of the Adani group by regurgitating old allegations that it over-invoiced coal imports. It also accused the FT of malicious bias and acting in cahoots with Hungarian-born American investor George Soros and the Soros-funded journalist network called Organized Crime and Corruption Project, which had provided a trove of documents for an earlier report in the paper.

These allegations, the group said, had not stood up to scrutiny before a customs tribunal and the Directorate of Revenue Intelligence (DRI), which had been pursuing the case, had been forced to withdraw an appeal before the Supreme Court early this year.

The Adani group’s statement had stoked enormous interest in the Financial Times report. When it came out on Thursday, it was evident that the paper had trawled customs databases in India and Indonesia, matched shipments, scoped sailing schedules and even used the services of a satellite data company to put together an entirely new set of charges.

An official for the Adani group said it was standing by the statement that was issued on Monday night.

Describing Gautam Adani as “Modi’s Rockefeller”, the paper wrote: “The unresolved nature of the DRI investigation and the apparent continuation of the alleged practices raise fresh questions about the relationship between Adani and the administration of Prime Minister Narendra Modi.”

The group used three middlemen companies to import coal to India. Hi Lingos which ran operations out of a residential address in Taipei, a Dubai-based company called Taurus, and a small Singapore firm named Pan Asia Tradelink which, the paper claimed, was “run by a former employee” of the Adani group.

The paper focused its attention first on 2,000 shipments totaling 73 million tonnes of coal that had been declared as imports by the Adani group between September 2021 and July 2023 — a period long past the earlier DRI investigation.

Of the 73 million tonnes of coal, shipments worth 42 million tonnes were made by the Adani group itself and were declared at an average price of $130 per tonne. The remaining 31 million tonnes were supplied by the three middlemen, the paper said. The average price declared for the coal supplied by these three firms was $155, a 20-percent premium worth $800 million.

The latest report says the second middleman in the coal shipments was Dubai-based Taurus, which is owned by Mohamed Ali Shaban Ahli. The paper said the name sounded similar but it couldn’t establish whether Mohamed was Nasser’s relative.

Adani paid Taurus $1.8 billion for 11.3 million tonnes of coal supplied since September 2021, according to the Indian records reviewed. But the most interesting player was Pan Asia Tradelink which “supplied Adani with 6.6 million tonnes of coal for $1.1 billion since September 2021”. “The average price of $169 per tonne was a 30 percent premium to the price of coal Adani sourced itself,” the paper claimed.

The paper was aware that prices of coal vary widely depending on its quality and the calorific value. It says that much of the coal supplied by the middlemen was of high quality based on calorific value, which is the total energy released on combustion.

So, it compared the coal supplied by the middlemen against a benchmark for Indonesian coal sourced from Argus, a data provider.

There were 311 shipments originating from Indonesia where the calorific value had been declared. “All but a few were priced at a premium to what the closest Argus benchmark price,” the paper said.

Often, they were much higher than the benchmark. One shipment by Hi Lingos, made in August 2022 with a declared calorific value of 5,004 kilo calories, carried a price tag of $179 per tonne.

“The highest price for the Argus 5000 calorie benchmark in the preceding three months was $145 per tonne,” the paper added.

(With inputs from agencies)