- Adani Group’s market capitalization soared past the USD 200 billion mark, Renewed Investor Confidence

- Rapid Growth Trajectory, However, allegations of fraud surfaced when the London-based Financial Times published a story based on George Soros-backed Organization’s report.

- Strong Rebuttal from Adani Group: “Baseless Allegations”

- Despite the controversy, Adani Group stocks remained unaffected, indicating market resilience.

- Market experts highlighted the strengthened fundamentals of Adani Group companies compared to previous years.

Adani Group’s market capitalization soared past the USD 200 billion mark (approximately Rs 16.9 lakh crore) on Wednesday, witnessing a notable increase of Rs 11,300 crore in its listed firms. This surge reflects renewed investor confidence in the conglomerate despite recent controversies surrounding its coal invoicing practices.

Investors displayed renewed confidence in the Adani Group despite recent controversies. The conglomerate, known for its diverse interests ranging from infrastructure to energy, witnessed a surge in market capitalization, highlighting the resilience and perceived value by investors.

Over the last two trading sessions, Adani Group has witnessed a significant rise in its market capitalization, amounting to a staggering Rs 56,250 crore, according to data from stock exchanges. This rapid growth trajectory underscores the market’s bullish sentiment towards the conglomerate, propelled by various strategic initiatives and business developments.

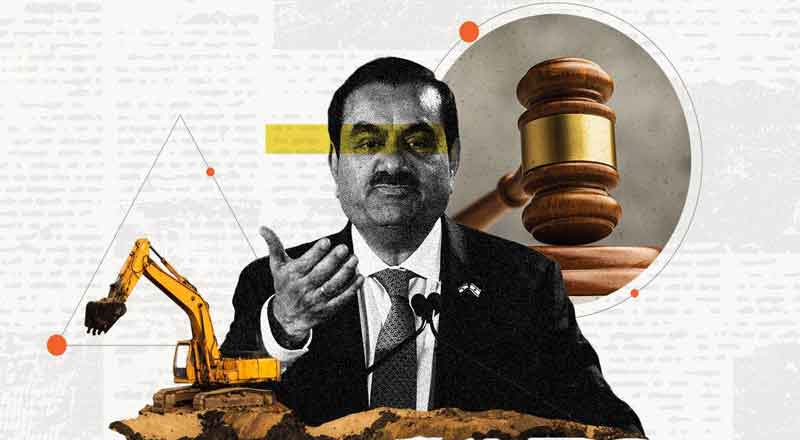

However, amidst this surge, allegations of fraud surfaced when the London-based Financial Times, citing documents from the George Soros-backed Organized Crime and Corruption Reporting Project (OCCRP), reported that Adani Group sold low-grade coal as high-value fuel in 2013. These allegations cast a shadow over the conglomerate’s reputation, prompting scrutiny from investors and stakeholders.

In response to the allegations, the Adani Group vehemently denied any wrongdoing, asserting that all coal supplies underwent rigorous independent testing at multiple stages. The group emphasized its commitment to transparency and adherence to regulatory standards, refuting the accusations of fraudulent invoicing.

A spokesperson for the group dismissed the allegations as baseless and absurd, emphasizing that the quality of supplied coal met permissible limits, and payments were contingent upon quality testing results. The group reiterated its commitment to ethical business practices and compliance with regulatory requirements.

Additionally, the group clarified that the vessel mentioned in the report had not been used for shipping coal from Indonesia until February 2014, refuting claims of fraudulent invoicing and emphasizing the accuracy of its business operations.

References to a Directorate of Revenue Intelligence (DRI) inquiry were dismissed as old allegations, with the group asserting full cooperation with authorities and no subsequent communication regarding deficiencies or objections. This assertion aimed to alleviate concerns regarding regulatory scrutiny and legal implications.

Regarding allegations of middlemen involvement, Adani Group stated that coal sourcing adhered to stringent criteria to avoid contractual non-fulfilment, considering its financial and reputational repercussions. This clarification aimed to address concerns regarding the integrity and transparency of the conglomerate’s supply chain practices.

Despite the controversy, Adani Group stocks remained unaffected, indicating market resilience and a nuanced approach by investors in assessing the situation. This resilience underscores investor confidence in the conglomerate’s long-term growth prospects and its ability to navigate challenges effectively.

Market experts, such as Deven Choksey, highlighted the strengthened fundamentals of Adani Group companies compared to previous years, projecting a robust trajectory for the conglomerate in the future. This positive outlook reflects optimism regarding the conglomerate’s ability to overcome challenges and deliver sustainable value to shareholders.

Over the past year, Adani Group’s market capitalization surged by 56.6 percent, outperforming the broader market index Nifty, which recorded a gain of 23.3 percent over the same period. This impressive growth trajectory underscores the conglomerate’s resilience and strategic initiatives, positioning it as a key player in the Indian market landscape.

(With inputs from agencies)