With the Asia-Pacific (APAC) region’s exposure to extreme weather events leading to unsustainable natural hazard losses and high inflation worsening them, reinsurers in the region will face challenges in their growth in 2023, says GlobalData, a leading data, and analytics company.

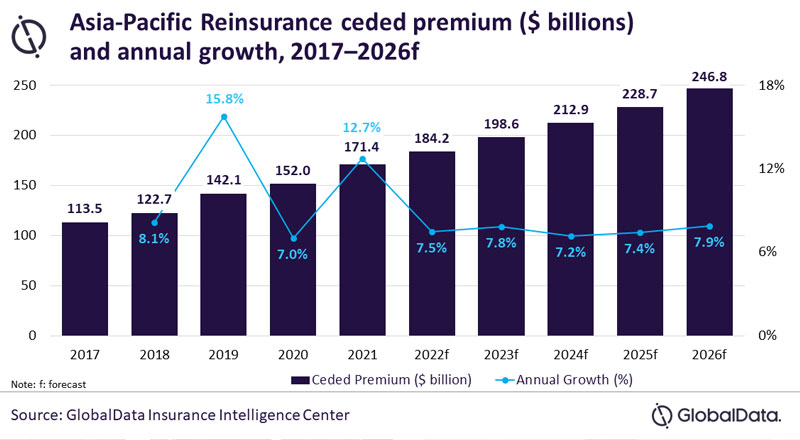

GlobalData’s insight report, ‘Reinsurance Market Size and Trends Analysis by Region, Business Lines, Top Markets, Regulatory Overview and Competitive Landscape, 2021-2026’ reveals that APAC’s reinsurance sector is set to grow at a compound annual growth rate (CAGR) of 7.6% from $171.4 billion in 2021 to $246.8 billion in 2026 in terms of ceded premiums.

APAC’s top five reinsurance markets in terms of ceded premiums are – Japan, China, Australia, Hong Kong, and South Korea. They collectively held an 84% share of APAC’s market in 2021.

Deblina Mitra, Senior Insurance Analyst at GlobalData, comments: “Increase in cost of claims due to the high inflation is adding pressure on reinsurers’ profitability. To reduce this, reinsurers are limiting coverage on loss-making lines, raising premiums, and pushing for higher deductibles by insurers. This in turn will prompt insurers to increase premium prices and retention levels to make a reserve for higher deductibles. For instance, Australian insurer IAG, in its January 2023 renewal of catastrophe reinsurance programs increased retention by 75% compared to July 2022.”

Aviation, marine, cyber, political violence, and trade credit insurance lines are anticipated to remain vulnerable to the ongoing Russia-Ukraine war losses in 2023. Insurers in the APAC region are also struggling to find suitable coverage for war risks for shipment of goods and natural gas supplies around the conflict zone as traditional reinsurers are exiting this line of business.

Mitra adds: “However, regulatory developments across the APAC region would have positive impact on reinsurance growth over the coming years.”

For example, reinsurance in Japan will benefit from the planned implementation of higher capital standards for insurers in 2025. The regulation is expected to create demand for reinsurance as it will put pressure on life insurers to increase reinsurance to reduce asset risks. Japan accounted for 35.2% of Asia’s ceded premiums in 2021 and is forecast to grow at a CAGR of 4.1% over 2021–26.

In China, reinsurers will benefit from the new regulation on reduced entry barriers. The regulation gives preferential treatment to foreign reinsurers if their solvency regulatory system is recognized in China. After this development, Mapfre Re established a subsidiary in China in 2022. China held a 25.6% share of the APAC’s ceded premiums in 2021. The ceded premium in China is expected to grow at a CAGR of 12.4% over 2021–26.

Mitra concludes: “In 2023, reinsurers in APAC will focus on risk management and limit their loss exposure due to the ongoing Russia Ukraine conflict and high inflation. The long-term growth, however, will remain stable due to favorable regulatory developments which will create new business opportunities for reinsurers.”