Interim Order Issued Against Patanjali and Baba Ramdev The Delhi High Court has directed Patanjali Ayurved and its promoters, including Baba Ramdev, to remove claims that allopathy doctors were responsible for the deaths of lakhs of people during the COVID-19 pandemic. This order was issued while promoting Patanjali’s Coronil as a “cure” for the virus. Justice Anup Jairam Bhambhani passed an interim order restraining Ramdev, his associate Acharya Balkrishna, and Patanjali Ayurveda from making such allegations. Court’s Directive and Rationale “I have directed the defendants to take down certain tweets…

Category: Business & Economics

Adani Wilmar Clocks Highest-Ever Net Profit At ₹ 313 Crore In Q1

Adani Wilmar Q4 Net Profit Jumps 67% To ₹ 156.75 Crore Adani Wilmar Records Double-Digit Percentage Growth In Q4 Edible Oil Sales Adani Wilmar Records 25% Volume Growth In Q1, Sales Value Decline By 12% Adani Wilmar Limited has reported its highest-ever net profit of ₹ 313 crore for the April-June quarter (Q1 FY25), marking a significant financial achievement. The company’s revenue reached ₹ 14,169 crore, driven by a 12% year-on-year (YoY) volume growth, as stability in edible oil prices supported strong earnings. The company achieved its highest-ever EBITDA of…

India’s Potato Production Faces Shortfall: Imports from Bhutan on the Horizon

Potato Imports to Stabilize Prices Indians may soon find potatoes from Bhutan on their plates. The Indian government is considering importing the vegetable due to anticipated price increases caused by lower production this year. A senior government official, speaking to The Economic Times on condition of anonymity, mentioned that apart from Bhutan, the Indian government is also exploring imports from other countries. The official stated that traders would soon be allowed to import small quantities of potatoes to manage the shortfall. Weather Woes and Production Challenges India, the second-largest producer…

Union Budget: Indian Startup Ecosystem Welcomes Abolition of Angel Tax

New Delhi: The Indian startup ecosystem on Tuesday hailed the Union Budget 2024 for abolishing angel tax — the tax imposed on funds raised by startups from angel investors — for all classes of financiers. Union Finance Minister Nirmala Sitharaman, in her budget speech, said that the move was aimed at bolstering the Indian startup ecosystem, boosting the entrepreneurial spirit, and supporting innovation. “The removal of angel tax is great news for early-stage startups and shows the government’s support for startup funding. The focus on creating jobs, developing skills, supporting MSMEs,…

US Stock Market Plunges After Tesla and Alphabet Quarterly Results

On Wednesday, U.S. stock indexes experienced their worst losses since 2022, triggered by quarterly profit reports from Tesla and Alphabet. These reports dampened Wall Street’s enthusiasm for artificial intelligence technology, leading to significant declines across major indexes. Major Index Drops Nasdaq Composite: The Nasdaq Composite recorded its largest single-day percentage drop since October 2022, closing at its lowest level since June 10. The index fell by 654.94 points, or 3.64%, to 17,342.41. Dow Jones Industrial Average: The Dow Jones Industrial Average dropped by 504.22 points, or 1.25%, closing at 39,853.87.…

India to Simplify GST Rate Regime in Coming Months

India plans to streamline its Goods and Services Tax (GST) rate structure in the upcoming months, according to Sanjay Agarwal, chairman of the Central Board of Indirect Taxes and Customs (CBIC). “Too many rates in goods and services tax are leading to classification disputes, and that needs to be resolved,” Agarwal stated in an interview on Wednesday. He emphasized the necessity of addressing these issues to enhance the efficiency of the tax system. The government is considering a reduction in the number of GST slabs from the current four to…

India Secures Strategic Terminal at Bangladesh’s Mongla Port, Outmanoeuvring China

India has clinched the rights to operate a terminal at Bangladesh’s Mongla port, situated in the Indian Ocean. This is a significant boost for India’s maritime strategy, particularly as it seeks to counter China’s expanding influence in the region. Previously, India secured rights to the Chabahar port in Iran and the Sittwe port in Myanmar. China has made substantial investments in port infrastructure from Gwadar in Pakistan to Djibouti in East Africa. Despite previous efforts, India’s progress with Chabahar and Sittwe has been slow, primarily due to geopolitical and security…

Budget 2024: India to Enhance Nuclear Energy Capabilities with Bharat Small Reactors

This strategic shift aims to make nuclear energy a substantial component It’s a departure from traditional large-scale nuclear plants It is aimed at offering more flexible and cost-effective nuclear power solutions In a significant move to diversify India’s energy portfolio, Finance Minister Nirmala Sitharaman unveiled major initiatives for nuclear energy development in the Union Budget 2024. The government plans to collaborate with the private sector to establish Bharat Small Reactors and advance research on small modular reactors and innovative nuclear technologies. Strategic Shift in Nuclear Energy This strategic initiative aims…

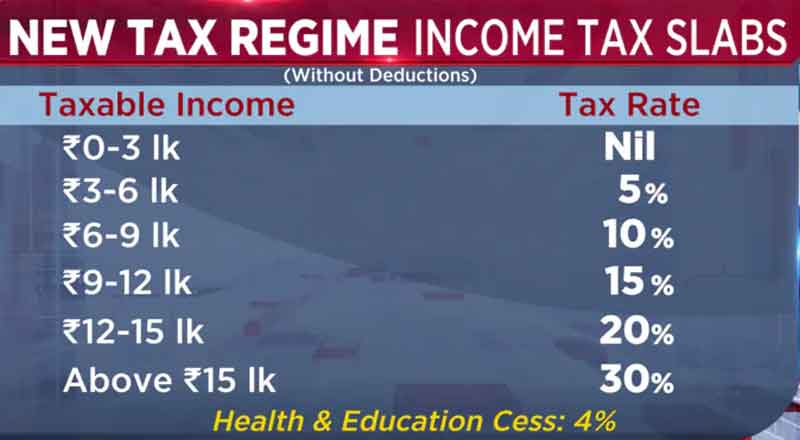

Revised Income Tax Slabs and Increased Standard Deduction in Budget 2024

In the first budget of the Modi 3.0 government, Finance Minister Nirmala Sitharaman announced significant changes to income tax slabs and standard deductions aimed at providing relief to taxpayers. The revised tax structure and deductions are expected to result in substantial savings for individuals, particularly benefiting the middle class. Revised Income Tax Slabs The new income tax slabs introduced in the Union Budget 2024-25 are as follows: Income up to Rs 3 lakh: Nil Income between Rs 3 lakh to Rs 7 lakh: 5% Income between Rs 7 lakh to…

Major Boosts for Andhra Pradesh and Bihar: Budget 2024-25 Unveiled

Finance Minister Nirmala Sitharaman presented her seventh consecutive budget on Tuesday for the fiscal year 2024-25, marking a significant moment with major announcements for Andhra Pradesh and Bihar. The budget includes substantial investments in infrastructure, education, agriculture, and youth employment, aiming to drive economic growth and development across these states. Andhra Pradesh Capital Development A landmark announcement was made for Andhra Pradesh, with the government pledging Rs 15,000 crore for the development of the state capital. This special financial support aims to transform the capital into a thriving hub of…