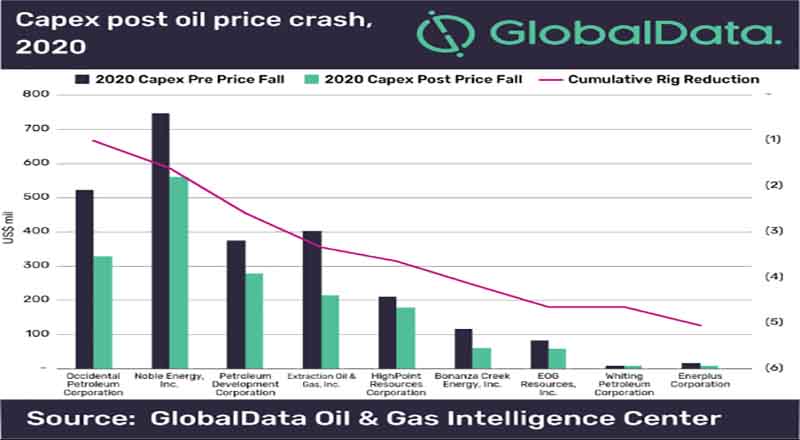

The oil price war has forced operators in the DJ Basin to drop rig count by 40% and reduce capital expenditure (capex) by US$ 384 million in 2020. By assessing the readjustment of capex for nine companies that account for approximately 75% of total DJ Basin production, leading data and analytics company GlobalData estimates a reduction of 44,438 barrels of oil equivalent per day (boed) in output for this group of companies as compared to the forecast for 2020 before the oil price crash.

Steven Ho, Oil and Gas Analyst at GlobalData, comments: “GlobalData analysis shows a five-rig reduction, from thirteen in March 2020 to eight by the end of 2020. Overall, this reduction brings down operators’ capex by an average of 29.5%.”

Ho continues: “With the current economic crisis and speculations around US West Texas Intermediate (WTI) potentially falling to US$10 per barrel (bbl) in coming months due to the global glut in oil supply, operators in the DJ Basin will rely heavily on their hedged production to sustain their cash flow. Highpoint Resources hedged 95% of their 2020 production, followed by Bonanza Creek Energy with 78% and Enerplus Corporation with 68%. The following operators have an upper hand compared to their counterparts to help brace through the current oil price volatility by having a strong hedged position.”