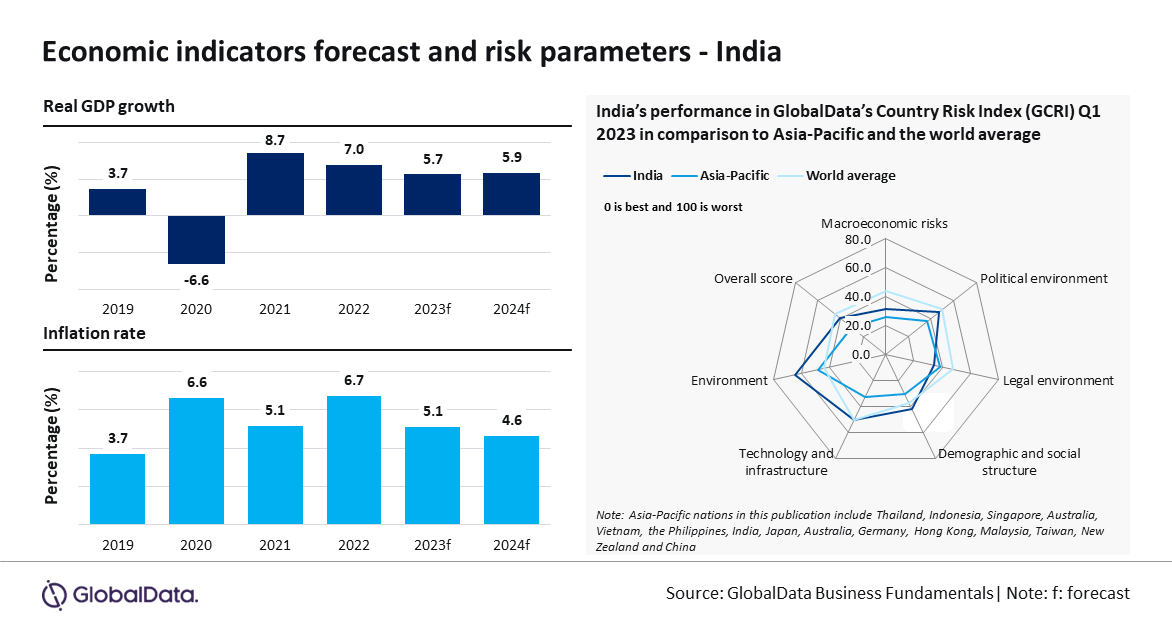

Amidst a gloomy global economic scenario, India emerges as a ray of hope and is positioned to achieve the highest GDP growth rate among major economies in 2023. The growth will be driven by robust private consumption and investment, supported by government efforts to enhance infrastructure, logistics, and the overall business climate. However, a decline in external demand may impact trade prospects this year. Nonetheless, the country is expected to maintain a solid pace with a projected growth rate of 5.7%, representing a slight slowdown from the 7% growth experienced in 2022, according to GlobalData, a leading data and analytics company.

GlobalData’s latest report, “Macroeconomic Outlook Report: India,” reveals that India’s GDP grew by 6.1% on an annual basis in Q1 2023, surpassing the previous quarter’s 4.5% growth. Private spending accelerated to 2.8% (from 2.2% in Q4 2022), public expenditure rebounded to 2.3% (-0.6%), and gross fixed capital formation increased to 8.9% (8%).

The economic growth in Q2 and Q3 2023 is expected to be driven by private consumption, supported by a revival in rural demand and increased manufacturing activity supported by benign inflation. India’s annual inflation rate dropped to 4.25% in May 2023, marking the lowest level since April 2021 and remaining closer to RBI’s inflation target of 4%.

Maheshwari Bandari, Economic Research Analyst at GlobalData, comments: “The Indian economy remained resilient amidst a global economic slowdown, driven by its robust domestic consumer market. However, the persistently high petrol and diesel prices continue to burden households and businesses. Contrary to expectations, these fuel prices are expected to remain unchanged over the next quarter as oil marketing companies aim to recover losses incurred during periods of elevated crude prices.”

In terms of sectors, financial intermediation, real estate, and business activities contributed 21.5% to the gross value added (GVA) in 2022, followed by mining, manufacturing, and utilities (20.0%) and agriculture (18.3%). In nominal terms, the three sectors are forecast to grow by 11.8%, 11.7%, and 11.7%, respectively, in 2023 as compared to the 15.1%, 13.2%, and 11.2% growth recorded in 2022.

The budget presented in February 2023 outlines a plan to increase capital expenditure by 37.4% to $121.9 billion, providing substantial support for the growth of the construction and related industries. GlobalData forecasts the construction sector’s gross value added (GVA) to witness an average annual growth rate of 11.1% from 2023 to 2025.

The discovery of large reserves of lithium in Rajasthan in May 2023, exceeding the previously discovered one in Jammu and Kashmir (February 2023), has the potential to meet 80% of India’s lithium demand, reducing dependence on China. This could make India self-sufficient in lithium production, which is crucial for the green energy transition.

On the external side, India’s exports in May 2023 declined by 10.3%, while imports fell by 6.6%, resulting in a trade deficit of $22.1 billion. This marks the fourth consecutive month of export contraction, posing challenges for economic recovery and the current account deficit. GlobalData projects the exports and imports growth to slow down to 4% and 3%, respectively, in 2023 from 4.2% and 4.6% in 2022.

Despite a decline in FDI from $84.8 billion in FY2022 to $71 billion in FY2023, there is optimism for a rebound as major US tech giants like Amazon, Google, and Microsoft announced significant investments during Prime Minister Modi’s US visit in June 2023.

Amazon pledged an additional $15 billion, bringing its total investment to $26 billion by 2030. Google is expected to open a fintech center in Gujarat, and Microsoft emphasized the transformative potential of AI to improve the lives of Indians. These initiatives are expected to support startups, accelerate digitization, foster job creation, and help improve GDP growth in coming quarters.

India is categorized as a manageable-risk nation and ranked 56th out of 153 nations in the GlobalData Country Risk Index (GCRI Q1 2023). The country’s risk score was lower in terms of macroeconomic, political, and legal risk parameters when compared with the average score of the world.

Bandari concludes: “India’s startup ecosystem has experienced remarkable growth, with a 15-fold increase in funding and a nine-fold rise in investors from 2015 to 2022. This influx of capital and investor confidence sets the stage for continued expansion, driving innovation, job creation, and economic growth of the country