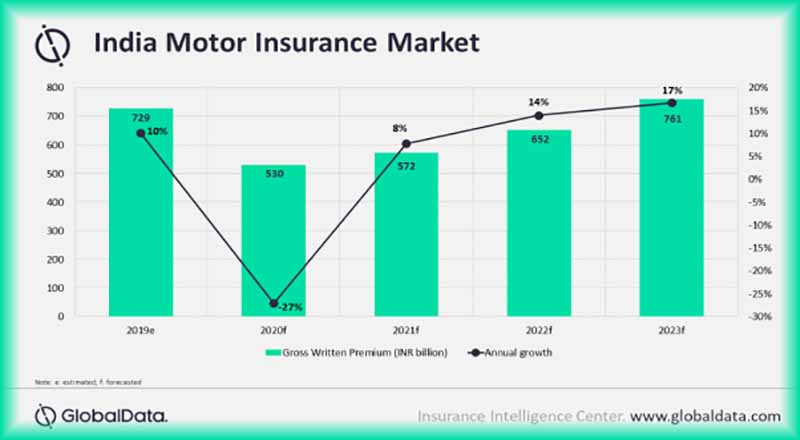

The Indian motor insurance business is expected to contract by 27.2% in 2020, a sharp decline from the 10.1% growth witnessed in 2019, according to GlobalData, a leading data and analytics company.

GlobalData has revised India’s motor insurance forecast in the aftermath of the COVID-19 outbreak. As per the latest data, motor insurance business is expected to register a compound annual growth rate (CAGR) of 1.1% over 2019-2023, compared to the earlier forecast of 11.3%. This is primarily due to the current economic uncertainty and lockdown restrictions imposed in the country to control COVID-19 pandemic.

Pratyusha Mekala, Insurance Analyst at GlobalData, comments, “The recent lockdown restrictions resulted in the decline of consumer spending and impacted the new vehicle sales. In June 2020, the passenger vehicles and two-wheelers sales declined by 50% and 40%, respectively, compared to June 2019. This has impacted motor insurance premium collections.”

According to the Insurance Regulatory and Development Authority of India (IRDAI), the overall motor insurance premiums registered a growth of 1% in June 2020, as compared to the previous year. This growth can be attributed to the higher share of renewal premiums.

Motor own-damage sub-segment declined by 2.7% due to fall in vehicle sales. However, the mandatory third-party liability segment reported 3.2% growth during the same period and supported the overall insurance growth in June 2020.

The recent regulatory changes following the pandemic also impacted motor insurance premium growth. In March 2020, the IRDAI put on-hold the proposed hike ranging between 2-10% on third-party liability insurance premium. Furthermore, the move to discontinue long-term own-damage motor policies, effective 1 August 2020, will also result in lower spending on motor insurance this year.

Ms Mekala concludes: “Despite the gradual revival of the economy, motor insurance business recovery is expected to be stretched. The pressure on new vehicle sales is likely to continue until 2021, resulting in sluggish growth in motor insurance premium.”