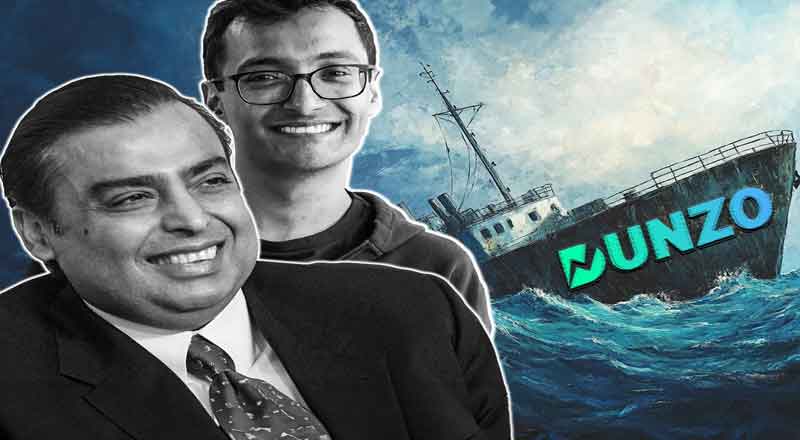

Reliance Retail’s recent decision to write off its $200 million investment in Dunzo marks a significant development in India’s quick commerce sector. This move comes amid Dunzo’s ongoing financial challenges and strategic shifts, shedding light on the volatile nature of the hyperlocal delivery market.

In January 2022, Reliance Retail acquired a 25.8% stake in Dunzo with a $200 million investment, aiming to enhance its presence in the burgeoning quick commerce space. This partnership was expected to leverage Dunzo’s hyperlocal logistics capabilities to bolster Reliance’s retail operations, including last-mile deliveries for JioMart’s merchant network.

Despite the initial optimism, Dunzo has faced significant financial hurdles over the past two years. The company has grappled with cash flow issues, leading to delays in salary payments and unsettled dues to former employees. These challenges have been compounded by intense competition from well-funded rivals like Swiggy’s Instamart, Zepto, and Zomato-owned Blinkit, making it difficult for Dunzo to maintain its market position.

The financial strain has precipitated notable leadership changes within Dunzo. Co-founder and CEO Kabeer Biswas recently resigned, following the earlier departures of co-founders Mukund Jha, Dalvir Suri, and Ankur Agarwal. In a bid to navigate the crisis, Biswas engaged in acquisition discussions with high-net-worth individuals and family offices, valuing the startup between ₹300 crore ($25–$30 million). However, talks with potential buyers like Swiggy and Tata’s BigBasket reportedly fell through, leaving Dunzo’s future uncertain.

Reliance Retail’s decision to write off its investment indicates a strategic withdrawal from Dunzo’s operations. Holding a 25.8% stake since January 2022, Reliance is no longer participating in discussions regarding additional funding or potential distress sales. This move suggests a reassessment of its quick commerce strategy, possibly redirecting focus towards internal capabilities or exploring alternative partnerships to strengthen its position in the competitive retail market.

The write-off underscores the challenges inherent in the quick commerce sector, characterized by high operational costs and fierce competition. Dunzo’s trajectory reflects the difficulties startups face in achieving sustainable growth amidst market pressures. For Reliance Retail, this development may prompt a strategic reevaluation of its approach to integrating rapid delivery services within its retail ecosystem.

As the quick commerce landscape continues to evolve, stakeholders will need to adapt to the dynamic environment, balancing innovation with financial prudence to achieve long-term success.