In the first budget of the Modi 3.0 government, Finance Minister Nirmala Sitharaman announced significant changes to income tax slabs and standard deductions aimed at providing relief to taxpayers. The revised tax structure and deductions are expected to result in substantial savings for individuals, particularly benefiting the middle class.

Revised Income Tax Slabs

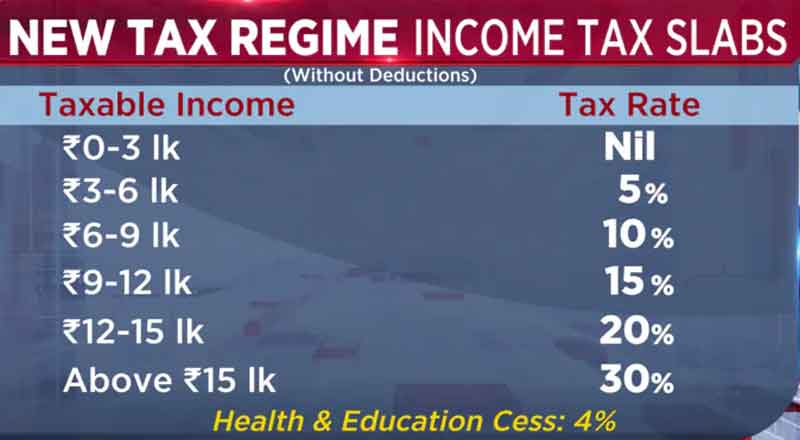

The new income tax slabs introduced in the Union Budget 2024-25 are as follows:

Income up to Rs 3 lakh: Nil

Income between Rs 3 lakh to Rs 7 lakh: 5%

Income between Rs 7 lakh to Rs 10 lakh: 10%

Income between Rs 10 lakh to Rs 12 lakh: 15%

Income between Rs 12 lakh to Rs 15 lakh: 20%

Income above Rs 15 lakh: 30%

These changes are part of a broader rationalization effort aimed at reducing the tax burden on individuals with lower incomes.

Increased Standard Deduction

The standard tax deduction has been increased from Rs 50,000 to Rs 75,000. This increase is expected to provide additional financial relief, contributing to a net annual saving of up to Rs 17,500 for individual taxpayers under the New Tax Regime (NTR).

Abolition of Angel Tax

To boost startups, the government has proposed abolishing the angel tax. This move is aimed at encouraging investment in new ventures and fostering innovation in the country.

Benefits to Middle Class Taxpayers

The revisions in tax slabs and increased standard deductions are expected to benefit the middle class significantly. Taxpayers in the highest bracket, with taxable income over Rs 15 lakh, will save Rs 7,500 due to the increased standard deduction. Additionally, rate rationalization will lead to further savings of Rs 10,000, bringing total savings to Rs 17,500 for this segment.

Detailed Changes in Tax Slabs

The specific changes in the tax slabs are:

Income between Rs 3 lakh to Rs 7 lakh: 5% (previously Rs 3 lakh to Rs 6 lakh)

Income between Rs 7 lakh to Rs 10 lakh: 10% (previously Rs 6 lakh to Rs 9 lakh)

Income between Rs 10 lakh to Rs 12 lakh: 15% (previously Rs 9 lakh to Rs 12 lakh)

National Pension System (NPS) Contributions

The government has increased the deduction limit for employers’ contributions to the National Pension System (NPS) from 10% to 14%. This change is intended to enhance retirement savings and provide greater financial security for employees.

Increased Deduction for Family Pensions

The deduction for family pensions is proposed to increase from Rs 15,000 to Rs 25,000. This adjustment will benefit around 4 crore salaried individuals and pensioners, providing additional financial support to families.

The changes announced in the Union Budget 2024-25, including revised tax slabs, increased standard deductions, and additional benefits for NPS contributions and family pensions, are aimed at reducing the financial burden on taxpayers and providing significant savings, particularly for the middle class. These measures reflect the government’s commitment to making the tax system simpler and more beneficial for salaried individuals.

(With inputs from agencies)