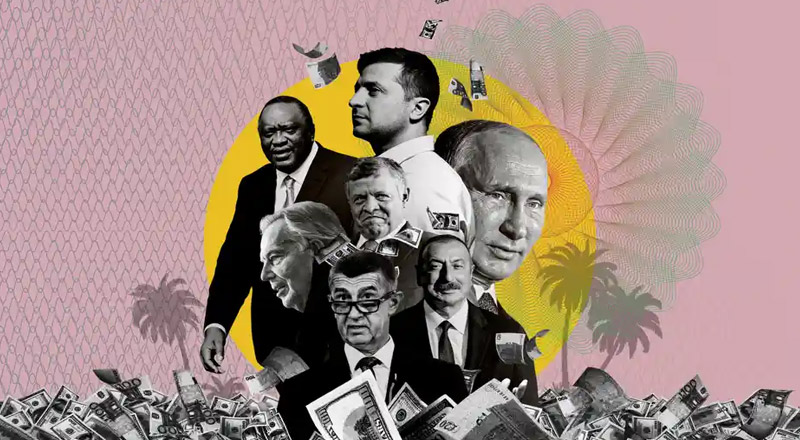

The unprecedented leak of the Pandora Papers has brought to light the offshore financial assets of dozens of current and former world leaders and hundreds of politicians from Asia and the Middle East to Latin America. The International Consortium of Investigative Journalists (ICIJ) obtained 11.9 million confidential documents from 14 separate legal and financial services firms. According to the group, the documents offered “a sweeping look at an industry that helps the world’s ultrawealthy, powerful government officials and other elites conceal trillions of dollars from tax authorities, prosecutors and others.”

Moving money through offshore accounts, in mostly low-tax jurisdictions, is legal in most countries. This is why many of the people named in the data release are not accused of criminal wrongdoing. But the journalist group said the 2.94 terabytes of financial and legal data, which makes it even larger than the 2016 Panama papers release, shows the “offshore money machine operates in every corner of the planet, including the world’s largest democracies,” and involves some of the world’s most well-known banks and legal firms.

Here are some of the biggest revelations in the release:

Jordan king’s real estate empire

Jordan’s monarch, King Abdullah II, used an English accountant in Switzerland and lawyers in the British Virgin Islands to secretly purchase 14 luxury homes worth $106 million, including a $23 million property in California overlooking a beach, the ICIJ reported. It is noteworthy here that the country relies on foreign aid to support its people and house millions of refugees. U.K. attorneys for the king however told the ICIJ that he was not required to pay taxes under Jordanian law, has never misused public funds and has “security and privacy reasons to hold property through offshore companies.”

French Riviera estate

Czech Republic Prime Minister Andrej Babis, who is currently running for re-election, has allegedly “moved $22 million through offshore companies to buy a lavish estate on the French Riviera in 2009 while keeping his ownership secret,” according to ICIJ. The five-bedroom Chateau Bigaud, is said to be owned by a subsidiary of one of Babis’s Czech companies, and sits on 9.4 acres (3.8 hectares) in a hilltop village where Pablo Picasso spent the last years of his life.

The Queen and Azerbaijan

The data release revealed that Azerbaijan’s ruling Aliyev family traded around $540 million worth of U.K. property in recent years, reported the Guardian. Queen Elizabeth II’s Crown Estate bought one property worth almost $91 million from the family, and is currently in the middle of an internal review into the purchase, the Guardian further said.

One of the most “troubling revelations” for the U.S. was the role of South Dakota, Nevada and other states that have adopted financial secrecy laws that “rival those of offshore jurisdictions” and demonstrate America’s “expanding complicity in the offshore economy,” said the Washington Post. A former vice president of the Dominican Republic finalized several trusts in South Dakota to store his personal wealth and shares of one of the country’s largest sugar producers, the paper said.

Pakistan’s political elite

Several members of Pakistani Prime Minister Imran Khan’s inner circle, including current and former cabinet ministers, “secretly owned an array of companies and trusts holding millions of dollars of hidden wealth,” the group reported. That could create a political headache for the former cricket star, who campaigned for the South Asian country’s highest office as the head of a reformist party that promised a strong anti-corruption agenda.

Tony Blair property purchase

Former U.K. Prime Minister Tony Blair and his wife saved around $422,000 by using an offshore company to purchase an almost $9 million office in London’s Marylebone area that was partially owned by the family of a Bahraini minister, the Guardian reported. The paper said there was nothing illegal about the deal, but it “highlights a loophole that has enabled wealthy property owners not to pay a tax that is commonplace for ordinary Britons.”