Current News

Politics

Sculpting a Decade: Sudarshan Patnaik’s...

A Masterpiece in Sand: Honoring an Era Sudarshan Patnaik created the story of Modi with sand, giving an artistic identity to the Prime Minister’s 11...

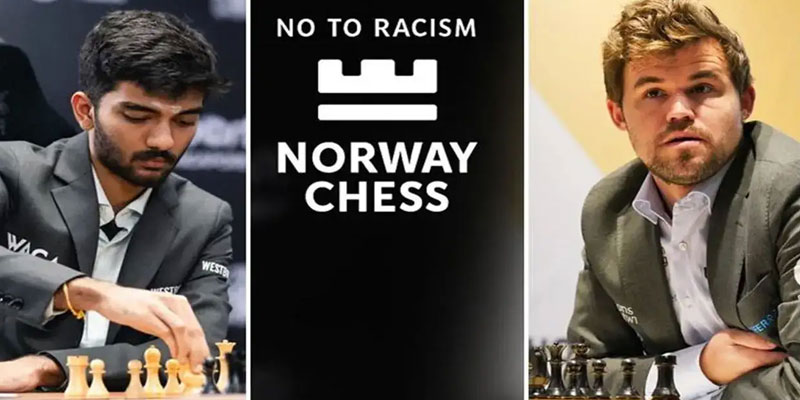

Sports

RCB’s Historic Win Ends in Tragedy: Stam...

From Jubilation to Devastation What should have been a historic day of celebration turned into a scene of horror at Bengaluru’s M. Chinnaswamy Stadium...

View More News

Copyright © All rights reserved. The images belongs to the respective copyright holders.