The world’s biggest tech companies operate largely out of their Irish subsidiaries, where they benefit from lower corporation tax than in the UK, new research shows.

Social networking sites Facebook, Twitter and LinkedIn also raise a significant percentage of total revenue in the UK, as opposed to the US where tax is higher.

The lower 12.5% corporation tax rate makes Ireland a lucrative base for companies, while the UK has a tax rate of 19% and the US an even higher rate at 21%.

Apple has saved over €16 billion euros by holding most revenue in Ireland rather than the US, while Microsoft has avoided paying €5 billion.

Ten of the world’s biggest companies have avoided paying €36.15 billion in tax by holding company operations in Ireland rather than the US, new research reveals.

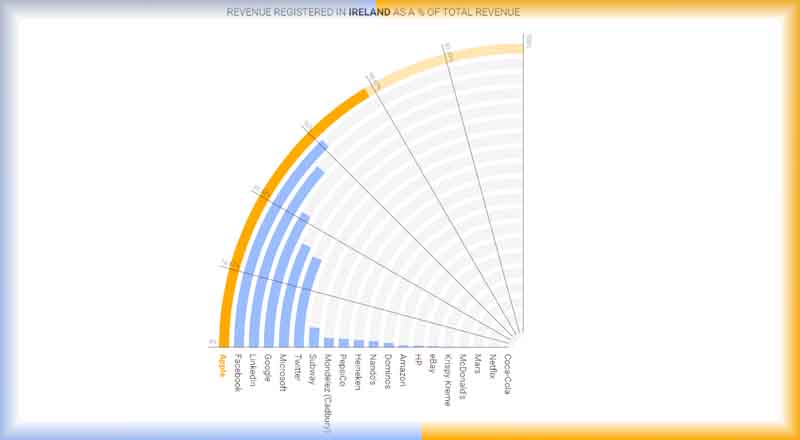

Tech giant Apple is based in California, yet over half of its revenue comes from a country with just 4.8 million inhabitants. By raising the majority of its total global revenue in Ireland, Apple has made substantial savings on corporation tax over the past year.

The Irish Money Funnel report also reveals that other notable tech companies, namely Facebook, Microsoft and Google, also pay the significantly lower corporation tax by registering revenue in Ireland, as opposed to the UK and US.

Comparatively, the UK-held revenue from the same 10 companies works out an extraordinarily insignificant 1.5% of total global sales, or €19.5 billion from a total figure of €844.7 billion.

The UK’s corporate tax rate is 19% – 6.5% higher than that in Ireland – making the Emerald Isle an attractive location for multinational companies looking to base themselves in Europe. However, this could be costing the UK essential funds, which could be used to improve the NHS or reduce homelessness.

With the money that Apple has saved by basing revenues in Ireland, the UK could hire 586,477 nurses, take 9,588,137 homeless people off the street, or take 2,982,777 children out of poverty. The sort of figures which would be enough to effectively end these social issues, just from the tax payments of one company.

Social media giant Facebook recorded a global revenue of just over €50 billion in 2018. Facebook Ireland raised over 50% of the total sum at €25.5 billion, resulting in a total tax bill of €63.2 million.

Other large social media platforms Twitter and LinkedIn also record a high percentage of profits in Ireland, at 26% and 46% respectively. According to 2018 figures, tech leader Apple has the highest percentage of its revenue coming from Ireland, with 65% of its €238 billion global revenue coming from its Irish holding company.

Apple’s tech competitors Microsoft and Google also operate largely from the Emerald Isle, with 28% and 35% of their total revenues coming from subsidiaries in Ireland.

To find out more about how much of the world’s top companies’ revenue is held in Ireland, please visit: https://www.spincasino.com/projects/irish-money-funnel/