Deteriorating job prospects and rising anxieties about personal finances drove a record drop in global consumer confidence in the second quarter of 2020, according to The Conference Board® Global Consumer Confidence Survey.

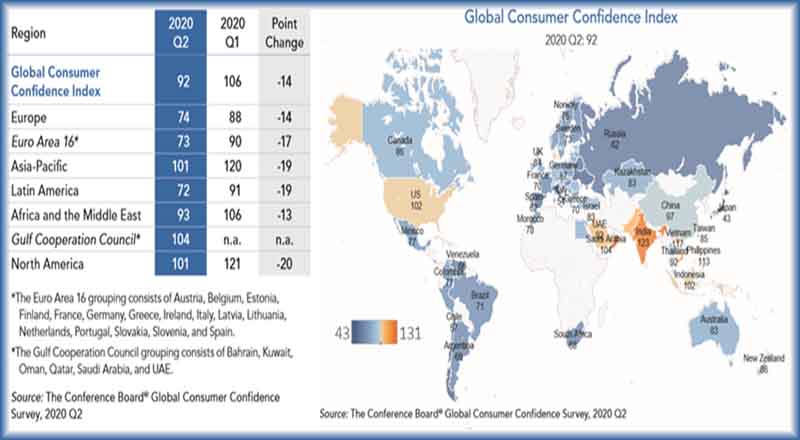

Conducted in collaboration with Nielsen, the survey found that overall global consumer confidence fell to 92 in the second quarter from a near-historic high of 106 early in the first quarter, before the pandemic significantly expanded beyond China.* A reading below 100 is considered negative, indicating that consumers were slightly more pessimistic than optimistic globally for the first time since 2016. The 14-point drop marks the largest period-on-period decline since the launch of the index in the first quarter of 2005. Moreover, the latest decline is twice as deep as the largest drop during the 2008-9 global financial crisis.

“Early signs of economic rebound in several markets do not necessarily portend a quick recovery in consumer confidence in the coming months,” said Bart van Ark, Chief Economist of The Conference Board and a report co-author. “Countries vary in their approaches to containing the pandemic, managing the direct impacts on employment and income, and the trust populations have in their governments, which all influence consumers’ confidence that a recovery will take hold.”

Additional takeaways from the survey include:

As the economic crisis evolves into a demand-driven recession, consumers are expected to remain pessimistic in most economies around the world.

- Globally, and especially in emerging markets—including Argentina, Brazil, and Russia—deteriorating job prospects and rising anxieties about personal finances drove down consumer confidence in 2020 Q2.

- In mature economies in North America and Europe, and especially within the Euro Area, the worsening job outlook spurred the decline in confidence levels. This was particularly pronounced in major markets such as the US, Canada, France, Germany, and the UK.

- In Latin America, and in some Asia-Pacific markets (including in Hong Kong, South Korea, Taiwan, and Thailand), diminishing expectations about personal finances over the next 12 months propelled the decline in confidence. This dynamic was also visible in South Africa and Turkey.

- In other markets, such as Italy, Spain, UAE, India, Singapore, and Mexico, the pandemic-induced domino effect—business closures and cuts in consumer spending leading to fading job prospects, deteriorating personal finances, and a further decline in spending intentions—played out more fully than in many other parts of the world, substantially weakening consumer confidence.

Consumers spent more on necessities, less on discretionary items, and saved more.

- During the second quarter, consumers spent more on essential products and services, undoubtedly reflecting their new homebound reality. At the same time, lingering restrictions on visits to stores, restaurants, and other venues, as well as financial concerns, depressed discretionary spending on categories such as entertainment, new clothes, and eating out.

- Consumers also saved and invested more in stock/fund investments during 2020 Q2 compared to Q1.*

- Consumers did slow down on some efforts to economize, however, especially on essentials: Attempts to save on gas and electricity, switch to cheaper grocery brands, and cut down on telephone expenses all declined from the previous quarter.

“Looking forward, more consumers than before plan to limit spending on annual vacations, rein in short trips, and spend less on out-of-home entertainment in the long term,” said Denise Dahlhoff, Senior Researcher, Consumer Research, at The Conference Board. “These plans to decrease spending on experiential categories may reflect both lingering social distancing rules as well as health and financial concerns.”

Consumer confidence is more resilient in markets where authorities have earned their citizens’ trust, both waning less during the crisis and rebounding faster afterward.

- In South Korea and Taiwan, for example, the rapid and effective rollout of preventative measures, coupled with reliable national health care systems and targeted social safety nets that allow workers to stay home without constraining their personal finances and spending, enhanced government trustworthiness and cushioned the fall in consumer confidence.

- In Sweden, by contrast, where trust in government interventions was also initially high, the relatively rapid increase in deaths and rise in unemployment in recent months caused consumer confidence to weaken substantially.

“Without enhanced public trust in government to mitigate the risk of second-wave outbreaks, consumer confidence will remain depressed over the coming months,” added Elizabeth Crofoot, Senior Economist at The Conference Board and a report co-author. “Consumers will stay cautious about pursuing out-of-home activities, while continuing to feel insecure about their job prospects and personal finances.”

3 key factors will determine the strength of the recovery.

- Increases in new cases and COVID-related deaths: A prolonged first wave of infections, and the looming threat of a second wave, will continue to suppress global consumer confidence.

- COVID’s economic impact on jobs and household incomes: Job cuts and furloughs have increased anxiety about reduced incomes and stressed household finances, weakening consumer demand. Even if the outlook starts to recover in the coming months, once government support programs for employers and workers (both in the US and abroad) wind down, consumers will reduce spending even more.

- Citizens’ trust in government, including its policies to mitigate the virus’s effects: Raising trust in government authorities will be key to increasing the likelihood that citizens will follow public health advice and begin to safely reengage in their local economy, leading to a faster recovery in consumer confidence.

The eventual recovery in consumer confidence will vary by region.

- In Asia-Pacific, countries well past the first wave of cases, such as China and South Korea, have successfully implemented strict containment policies and have begun to open up their economies again. As new outbreaks are quickly identified and isolated, confidence in those markets will likely rebound fairly quickly. In contrast, other Asian markets, including Indonesia and India, have struggled to provide an effective policy response and may recover more slowly, especially as cases continue to accelerate.

- Europe has much diversity in the policy response: Germany’s proactive containment measures and wage subsidy program, both among the most robust in Europe, may support a swifter recovery. But in the UK, delayed policy responses may result in greater job and income losses, leading to an extended period of low confidence.

- In the Gulf Cooperation Council* and North America, especially in Canada, the decline in oil prices adds to the pressure on consumer confidence. In the US and Mexico, where the opening up of the economy has in several cases coincided with rising infection rates, consumer confidence will likely remain depressed for a sustained period.

*A note about our 2020 Q2 survey results and index

- Beginning with the 2020 Q2 data sample, The Conference Board® Global Consumer Confidence Survey includes four additional markets in the Middle East: Bahrain, Kuwait, Oman, and Qatar. These countries, together with Saudi Arabia and the United Arab Emirates, constitute a new aggregate for the Gulf Cooperation Council (GCC).

- China was also reintroduced into the sample for 2020 Q2, having been excluded from the 2020 Q1 index due to the country’s restrictive COVID-19 containment measures during that period.