- The anticipation surrounding the Lok Sabha election results has set off a remarkable rally in India’s stock market.

- The Sensex stimulated upwards by over 3,500 points and enriched investors by a staggering Rs 26 lakh crore.

- Historical trends suggest that market volatility is the norm in the run-up to election results.

- In past instances, such as in 2004 and 2019, the market witnessed significant swings before and after election outcomes.

- Currently, market sentiment seems to have priced in the expectation of the BJP securing around 300 seats.

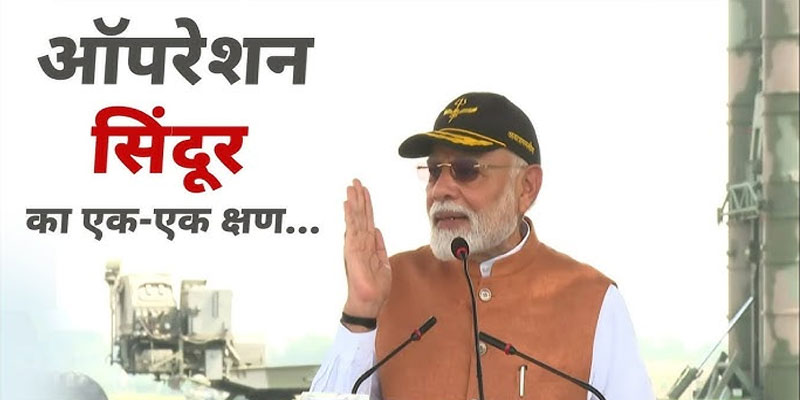

- In a recent interview, Prime Minister Narendra Modi expressed confidence that the stock markets would reach record highs on June 4, 2024, attributing this optimism to his government’s pro-market reforms.

The anticipation surrounding the Lok Sabha election results has set off a remarkable rally in India’s stock market, propelling the Sensex upwards by over 3,500 points and enriching investors by a staggering Rs 26 lakh crore. Since the commencement of voting on April 19, the Sensex has soared from a low of 71,816.46 to a closing high of 75,390 on Monday, witnessing a gain of more than 3,570 points. This surge has seen the market capitalization of all BSE-listed stocks surge to Rs 419.95 lakh crore, marking a substantial increase of Rs 26.36 lakh crore.

Historical trends suggest that market volatility is the norm in the run-up to election results. In past instances, such as in 2004 and 2019, the market witnessed significant swings before and after election outcomes. The Nifty dropped sharply by 21.5% in 2004 when the Congress-led UPA won power, while it surged nearly 22% in 2009 when Manmohan Singh retained his position. In 2014, ahead of Narendra Modi’s historic victory, the Nifty rose by 5%, and in 2019, it saw a 3.5% increase.

Currently, market sentiment seems to have priced in the expectation of the BJP securing around 300 seats. However, industry insiders caution that a result with fewer than 280 seats for the BJP could unsettle investors, potentially leading to significant market stress. Conversely, a landslide victory for the BJP, exceeding expectations, could provide a further boost to market sentiments.

In a recent interview, Prime Minister Narendra Modi expressed confidence that the stock markets would reach record highs on June 4, 2024, attributing this optimism to his government’s pro-market reforms. Modi’s confidence stems from his belief that the BJP will secure a record number of Lok Sabha seats on the same day, further bolstering market sentiments. Echoing similar sentiments, Home Minister Amit Shah also predicted that the Indian stock market would achieve new records on June 4, coinciding with the announcement of the Lok Sabha election results.

Industry experts believe that the market is building a bullish case based on BJP securing around 300 seats and the NDA as a whole garnering around 330-340 seats. However, they caution that a deviation from these expectations could lead to market surprises.

Looking ahead, sectors such as infrastructure, manufacturing, domestic cyclicals, select financials, and state-owned enterprises (PSUs) are expected to outperform, while consumer and IT sectors may underperform. Small and midcap stocks could temporarily outshine large-cap stocks.

However, amidst the anticipation, the stock market witnessed a slight downturn on May 28, with both the Sensex and Nifty experiencing a decline of 0.2 percent. Increased volatility saw the India VIX, or the fear gauge, rise over 5 percent to 24.5. Oil and gas, as well as power stocks, were among the major laggards, contributing to the decline in the Nifty 50.

In conclusion, while the surge in the stock market has been fueled by optimism surrounding the election results, investors remain vigilant as they navigate through the volatile terrain of Indian politics and its impact on the economy.

(With inputs from agencies)