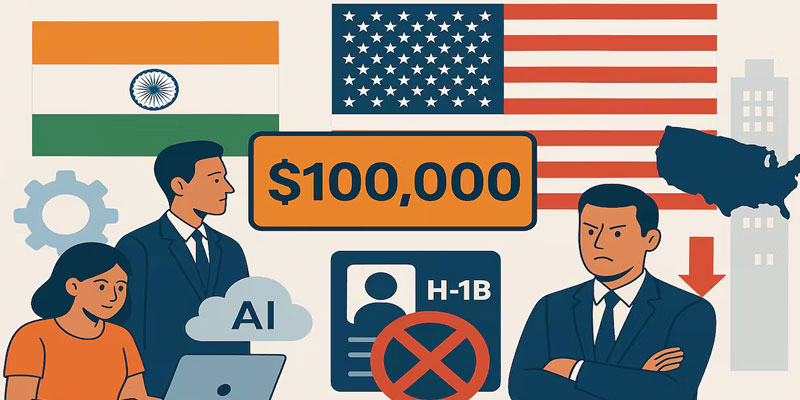

A Policy Shock That Shakes the Foundation

The U.S. has long been the lifeline of India’s IT services industry, but that bond is under stress. President Donald Trump’s sudden move to impose a $100,000 fee on new H-1B visas has jolted the $283 billion sector. For companies like TCS, Infosys, Wipro, and Tech Mahindra, the levy is not just a financial hurdle—it threatens to dismantle a decades-old model of rotating skilled engineers into American projects.

Stock Market Shockwaves

The fallout was swift. The Nifty IT index fell over 2.5% in early trade Monday, with all 10 constituents in the red. Tech Mahindra plunged 6%, while Persistent Systems, LTI Mindtree, and Mphasis also tumbled. Infosys and Wipro’s U.S.-listed shares dropped too, highlighting the global hit.

Visa holders scrambled to travel before the rule took effect, fearing heavier costs. A later clarification—stating the fee is a one-time charge for new applicants only—brought temporary relief but did not calm long-term concerns.

Declining Reliance, But Persistent Exposure

Though firms have reduced dependence on visas, exposure remains significant. About 20% of top IT firms’ staff work onsite in the U.S., according to Motilal Oswal. India also accounted for 71% of H-1B approvals last year, underscoring how central the program remains.

With 57% of revenues tied to the U.S., the added cost reflects more than fees—it signals a shift in Washington’s stance on foreign talent.

Disrupting Business Models

The traditional onsite-offshore delivery model faces disruption. Analysts expect contract delays, repricing, and reduced onshore staffing, pushing firms to accelerate offshore delivery and hire more locally.

The policy also dims prospects for Indian engineers hoping to chase the “American Dream,” as companies scale back cross-border movement.

Nasscom warned of risks to America’s innovation ecosystem, while economists see the move as part of a broader trade and tech standoff.

Experts predict firms will redirect work to hubs in India, Mexico, and the Philippines, while U.S. corporations may lean more on automation and AI to bridge staffing gaps.

The Rise of Global Capability Centers

One clear outcome: faster expansion of Global Capability Centers (GCCs). These units, once back-office support, now handle R&D and innovation. Trump’s policy is expected to accelerate GCC growth in India, Canada, Mexico, and Latin America.

India already hosts more than half of the world’s GCCs, with numbers projected to exceed 2,200 by 2030, creating up to 2.8 million jobs.

Reinvention Amid Disruption

The H-1B shock is painful but could spur a strategic reset. Indian IT firms will be forced to move beyond visa-led growth, invest in GCCs, strengthen offshore models, and build local talent bases.

Margins may be squeezed in the near term, but long term, the industry could emerge more resilient, diversified, and innovation-driven, better equipped for a world where politics and technology increasingly collide.

(With agency inputs)