There has been an intense attention on improving farmer’s income. Finance Minister Arun Jaitley had in his 2016 budget speech, promised to double farmers’ income by 2022. “We need to think beyond food security and give back to our farmers a sense of income security.” he said. While such a move is is laudable and welcome, let us also see what prompted a countrywide response towards focusing more on income security of farmers.

The Debt Crisis:

Almost 70% of India’s 90 million agricultural households are spending more than they earn each month on average says an IndiaSpend analysis based on various government data. These conditions themselves push the farmers them towards debt, which is the primary cause in more than half of all farmer suicides in the country.

These figures show that the debt crisis is not just a result of some farmers being unsuccessful in their occupation but rather it is a overall vicious cycle gnawing at the whole of agricultural community.

The Overwhelming Agricultural Debt Crisis of Punjab:

Of all the discussion about agricultural debt the case of Punjab has been the highlight. Punjab has been known for its agriculture and for its glorious share in overall national produce. But in recent years Punjab has been staring at an grave agrarian crisis with vast accumulation of farm debt.

A huge role has also been of inadequately planned policies. In the effort to prioritize short-term food security, it neglected long-term sustainability. Punjab farmers adopted the current mono-culture of rice-wheat cropping pattern having been lured by better MSP for rice and wheat. In the process crop-diversification was abandoned. While MSP for crops have been going down, input costs have only risen, while the soil fertility and productivity has fallen.

Farmers from Punjab stage a protest at Jantar Mantar, New Delhi

As per report from State Level Bankers’ Committee (SLBC) NPA in agriculture advances swelled by over Rs 800 crore to a “worrisome” figure of Rs 6,611 crore in six months.

Here is the brief assessment of average debt for 2017-18:

Per farming household: Rs 1.03 Lacs

Role of Weather Risk Management System (WRMS) in Debt Protection:

Indian farming has always been heavily dependent on the mercy of nature. Sudden changes bring out a lot of losses, this unpredictability itself is one of the major causes of agricultural losses and debts.

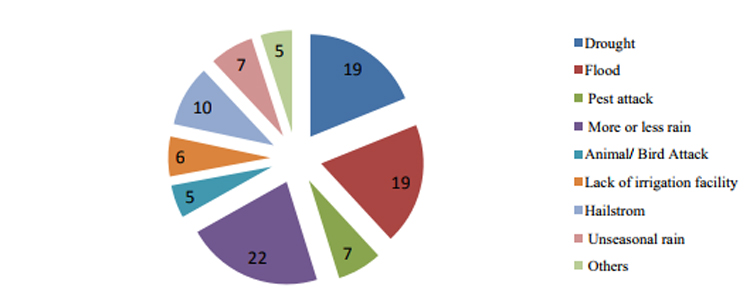

The survey states that approximately 70% of Indian farmers said that their crops got destroyed in the last three years. Primary reasons for which have been uncertain rainfall, drought and flood, destruction of crop by diseases and birds/animal, and lack of irrigation.

It is to protect against these calamities that having a debt protection helps immensely. The PMFBY is aimed at aiding farmers do this by massively funding insurance and ensuring that even small farmers get this benefit.

Founded in 2004, WRMS has pioneered the weather insurance industry in India and has already bailed out over 5 lakh debt-ridden farmers. It has taken the quest of debt protection and loss prevention under PMFBY even further.

It seeks to help over 2 crore farmers in its quest to facilitate them through their climatic expertise and provide prior support through innovation and technology.