India has developed a reputation for the back-office function, whether in software or hardware, whether for British Telecom or Texas Instruments. It became the butt of jokes about cheap talent. There have even been television comedy series about the goings-on at Indian back offices, especially for call centers.

Today, nearly 30 years after I filed my first article, times are changing. Both India and China are finding their own confidence. China is clearly motivated to clear the hurdles erected by the U.S.-China trade war, and India is awash in nationalist sentiment, propagated by the country’s prime minister and the enthusiasm he stirs up for everything Indian. Indeed, this newfound fervor isn’t restricted to India and China; nationalist sentiment is popping up everywhere.

In India, one result has been a spate of programs focused on creating self-sufficiency in many areas, including electronics and semiconductor industries. But it’s not just political and social change that’s driving India’s electronics industry resurgence.

The last three decades have seen Indian engineers gain confidence, demand higher salaries, figure out how to move up the value chain, and even branch out from the corporate environments of companies like Texas Instruments, NXP, and Cadence to create their own startups. One high-profile example is Ganapathy Subramaniam, a former director at Texas Instruments in India who co-founded Cosmic Circuits in 2005. When Cadence acquired Cosmic Circuits in 2013, Subramaniam branched out again to invest in other semiconductor-related companies, working alongside Lip-Bu Tan at WRVI Capital.

India’s fledgling fabless semiconductor ecosystem is also getting fresh impetus with the help of Indian engineers and entrepreneurs who have returned home after building successful careers in Silicon Valley. I caught up in London last year with one such veteran, Sateesh Andra, who came back to India to set up a fund that invests in intellectual property (IP)-led product startups. Andra told me the firm looks for companies whose developments are “globally relevant.”

Sanjay Gupta, vice president of engineering and India country manager for NXP Semiconductors, shared the perspective of a 24-year industry veteran when I visited him at his office in Noida, India, late last year. “I’ve seen the industry transforming from a back-office industry with a lot of translation work coming to India, like the back-end technologies for technology transformation, or maybe low-end verification work,” Gupta said. “In the last two-and-a-half decades, there’s been a complete transformation in the value chain both for Indian companies and also for global companies like NXP operating out of India. We see more and more talent base in India contributing to cutting-edge technologies, next-generation architectures for prime areas of focus for the company.”

Indeed, he said, these engineers are “not just contributing; they are leading some of the very key, global-impact projects from India. At NXP, a lot of next-generation ADAS [advanced driver-assistance system] products for targeting driverless cars are actually being driven out of India.” Those products include “a radar-based product line, vision-based product line, and many more.”

I asked Gupta to assess the Indian industry’s potential impact both locally and globally. “In the next five years, the scenario may not change much,” he said, “but beyond five years, I believe transformational changes and structural changes [will be] happening at multiple levels. There’s a big mindset change in government and bureaucracy that India needs to play a very active role in next-generation semiconductor development, and it will be a big enabler even for bridging the physical deficit challenges that India has — semiconductor imports being one of the biggest imports, after oil. This is why there’s a very significant focus from government directly on initiatives like Make in India, Invest in India, and Design in India.

“The second factor is from the industry itself. The kind of talent we have in the country today, compared with 20 years ago, means we are all set for a lot of indigenous development, enabling a stream of local semiconductor development. And I see a lot of startup companies within India that are actually growing up.”

That’s what I see, too: The Indian semiconductor industry is growing up. It’s no longer just about outsourcing. But there’s still some way to go before we see major Indian chip companies starting to dominate globally.

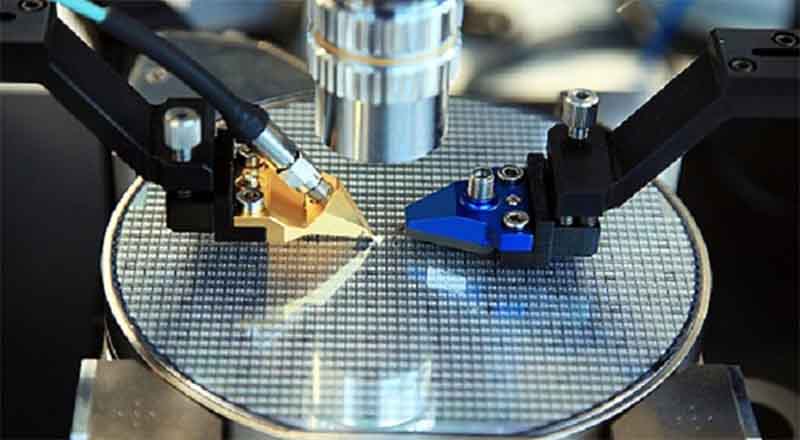

The debate about whether India can build and sustain its own semiconductor fabrication facility will probably persist for some time, without much progress, because of the level of investment and the infrastructure required. However, there may be progress toward a viable homegrown fab if the planners focus on older process technologies rather than manufacturing at the bleeding edge.