Current News

Politics

Court to Rahul Gandhi: Free Speech Doesn...

Rahul Gandhi Faced Allahabad High Court Heat Over Remarks on Indian Soldiers Congress leader Rahul Gandhi faced a legal setback on Wednesday when t...

Sports

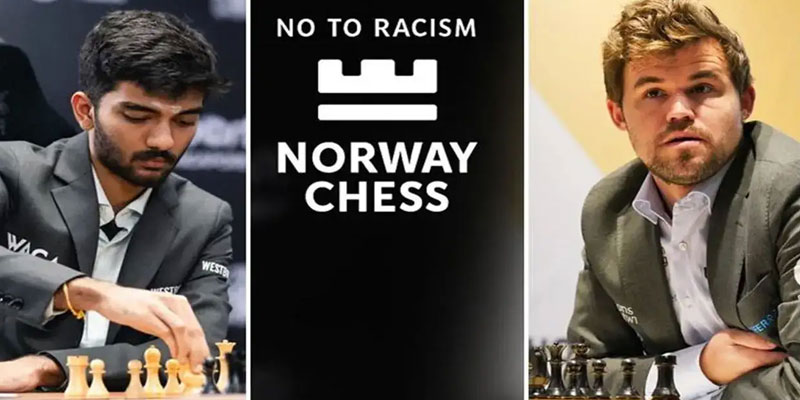

Racism Mars Gukesh’s Landmark Win Over C...

A Historic Victory Overshadowed The organisers of Norway Chess 2025 on Tuesday issued a strong condemnation of racist remarks made against Ind...

View More News

Copyright © All rights reserved. The images belongs to the respective copyright holders.