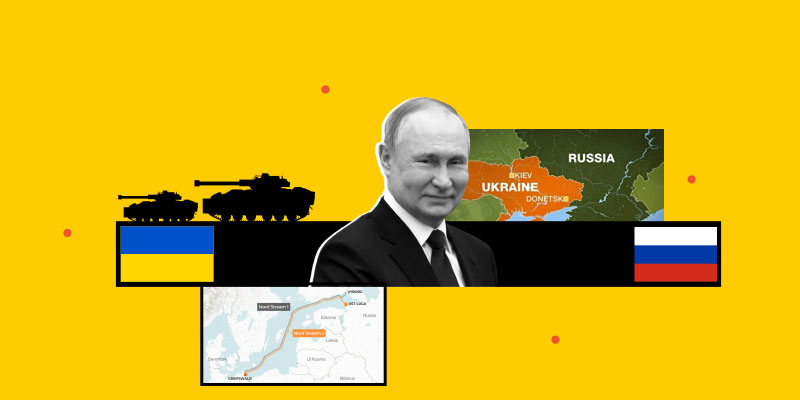

Russia’s Kremlin has rejected US assertions that India agreed to stop purchasing Russian crude, reiterating New Delhi’s sovereign right to procure oil from any source. The clarification follows recent statements from Washington suggesting that an India-US trade understanding included a pivot away from Russian supplies. So far, India has not formally confirmed any commitment to end Russian oil imports as part of the reported trade arrangement, reinforcing the country’s longstanding policy of diversified sourcing based on economic and strategic considerations.

Trade Signals and Strategic Ambiguity

The controversy emerged after US President Donald Trump announced a new India-US trade framework featuring tariff reductions and expanded American energy exports. According to his remarks, India had indicated willingness to scale back Russian oil purchases in favor of US and Venezuelan supplies. Moscow swiftly countered the claim, noting that New Delhi had issued no such statement and emphasizing that India has historically bought energy from a wide range of suppliers. The episode underscores the delicate balance India maintains between deepening ties with Washington and preserving a pragmatic energy relationship with Moscow.

India’s Import Structure and Economic Realities

India imports close to 88% of its crude requirements, making price and reliability central to policy decisions. Russian oil, particularly discounted Urals grades, has accounted for roughly 1.1–1.5 million barrels per day in recent months—around a third of total imports—keeping Russia among India’s top suppliers. These barrels are well suited to India’s complex refineries and are often cheaper than alternatives. While US crude has gradually entered India’s basket, its lighter quality typically requires blending and higher transport costs. Long-term contracts and refining economics make an abrupt shift away from Russian supply unlikely in the near term, with analysts expecting volumes to remain broadly steady through early-2026.

The Trade Deal Narrative

The proposed trade arrangement between India and the United States reportedly includes tariff reductions on Indian exports and commitments to expand bilateral commerce in energy, technology, and agriculture. Washington framed the agreement as a significant step toward reducing trade barriers and increasing US exports. Prime Minister Narendra Modi welcomed the tariff relief and broader economic cooperation but did not mention any specific commitment regarding Russian oil. Many observers view the understanding as a limited or “mini” deal that aims to reset trade tensions while leaving sensitive energy issues deliberately ambiguous.

Geopolitical and Strategic Implications

Russia has an interest in maintaining its energy partnership with India, now one of its largest buyers after Western sanctions reshaped global flows. Moscow’s response appears designed to preserve this relationship without escalating tensions with the United States. For India, the challenge lies in balancing relationships: Russia remains a crucial supplier of discounted energy, while the US is an important partner in technology, defense, and trade. Cutting Russian imports entirely could raise India’s energy bill significantly and strain refiners dependent on affordable crude. Meanwhile, alternative suppliers such as Venezuela face logistical and regulatory hurdles that limit their immediate role.

Multi-Alignment and Energy Pragmatism

The current dispute highlights how energy trade sits at the intersection of diplomacy and domestic economics. India’s silence on the specific US claim suggests a cautious approach aimed at preserving flexibility. Rather than committing to a binary choice, New Delhi appears set to continue a multi-alignment strategy—incrementally increasing US imports while maintaining Russian volumes where commercially viable. Ultimately, India’s energy decisions are likely to be driven less by geopolitical pressure and more by cost, supply stability, and long-term security, ensuring that diversification remains a gradual and pragmatic process rather than a sudden shift.

(With agency inputs)